The Value Connection – Q2 2021

Things are coming back to life after a year of dormancy. There are energy and a sense of hopefulness that was missing over the prior year. As a nation, we are reopening. There is a diminishing guardedness to be around our fellow humans. Children should be able to resume their traditional education methods in the fall. And the unnerving uncertainty of the markets and the economy is dissipating. There is no doubt, this year will be better than the last.

At O’Keefe Stevens Advisory, we weathered the last 12 months with resiliency that I am proud of. Our team is now bigger, stronger, and has a greater capacity to work from anywhere. Our systems and processes have gone paperless. Our relationships with you are still strong. Because of new technologies, we now have many options to connect to you. We look forward to resuming in-person interactions when you feel comfortable. And, in time, we will host some events to introduce our new team members and catch up with you in a social setting.

This quarter we have some great information to share with you. We are focusing on ways to increase your engagement with our team. We recognize high engagement in our process yields the best outcomes for you. We have a record number of pre-registrants for this quarter’s investor call. Thank you for tuning into these updates. Listening to these calls provides insights into value investing. This understanding leads to confidence and patience. And patience leads to better outcomes when investing for the long term.

Thank you to those of you who have reached out to us in the past few months. Your letters of gratitude mean a great deal to us. It brings our team joy to do this work on your behalf. We continue to strive to better serve you. We keep looking for ways to personalize our work together and appreciate your trust in us. Enjoy the spring!

Welcome Dominick!

Dominick D’Angelo joined our team on April 1st as a Research Analyst. Dominick will manage research for the Firm portfolio in collaboration with Peter. He will become familiar with our processes while studying for the final CFA exam this spring.

Dominick received a Bachelor of Science in Finance & Economics from Canisius College. He worked for several years in investment analysis with a value approach.

His experience includes time with the Ohio Public Employees Retirement System and The Rose Hill Group of WNY LTD. Dominick has followed O’Keefe Stevens for the past several years. We share the value investment philosophy and Dominick has an excellent analytical skillset.

Dominick is an avid golfer. He enjoys listening to podcasts, Buffalo sports teams, and reading. We look forward to introducing him on our April 14th Quarterly Call.

Book Review: Atomic Habits by James Clear

James Clear dedicated his life to the study of habits and how to be successful at them. His personal journey with habits has yielded amazing results. Atomic Habits is a New York Times best-seller and sold over 3 million copies. Clear is an in-demand speaker to Fortune 500 companies. Today he has over 1,000,000 subscribers to his weekly emails.

The thing I like most about this book is how relatable and approachable it is. It goes beyond explaining how to start (and stick to) good habits. It gets into the details about making good choices and avoiding bad choices. Since reading the book, I have installed a daily meditation habit and I have not missed a workout in over 2 months. The best part is it is not overwhelming to install these tactics.

We all have lots of room for improvement and our habits shape our lives. I recommend Atomic Habits to increase the effectiveness of your personal development projects. It does not matter if you are trying to read more, eat better, or get to the gym more often. James Clear has a process that works.

I listened to the audiobook first and then read the hardcover. Either method will get the job done. I look forward to hearing from some of you about the new improvements you are working on in our next review meeting!

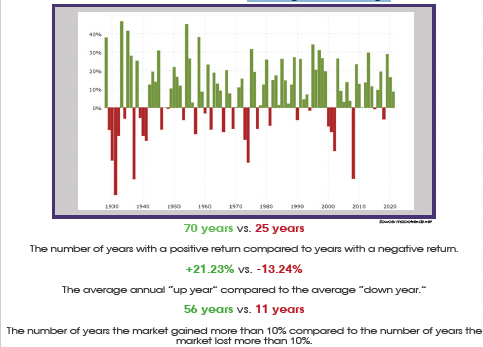

By the Numbers: A Look at the Historic Returns of the Market

Written by: Adam Deutsch

For many years before I joined O’Keefe Stevens, I worked with 401k plan participants. My job was to get people saving into their plans and to increase their current savings. In my presentations, I would share some insights about the markets. The idea was to teach savers the long-term benefits of staying invested.

You may have heard that the stock market returns an average of 10% per year. If anyone can buy an S&P 500 index fund and get these great returns, why wouldn’t they do it? I suspect many OSA clients realize it’s not quite so simple. (Hence, why we are working together).

While 10% is the approximate long-term annual growth rate, the path to get to the average is full of variance. When you dig in deeper, the year-by-year results provide interesting insights.

To spare you the time of crunching the numbers, I thought this chart would help visualize the data. I also keep a few key facts about the above chart for your consideration. This exploration provides some interesting perspective. For instance,

Each year I update the stats on the history of S&P 500 market return data dating back to 1926. As it stands through 2020, the average annual return is 10.22%. Since I’m a numbers guy, I thought it would be interesting to know how we got to the average.

By now, you have likely noticed the dramatic recovery from the March 2020 market lows. Investors who stayed invested through the challenging time have recovered their losses. Those who recognized the opportunity and invested have experienced outstanding returns.

Here at O’Keefe Stevens, we know behavior is the dominant factor in your success as an investor. It’s the main focus of our work with our clients. When we experience a year like 2020 or 2008, our focus shifts to the behavioral coaching aspects of our work. We know that “this too shall pass” and our work is to keep our clients invested during challenging times.

Because last year was so difficult, I thought it would be instructive to share these stats with you. You might even enjoy showing them to some of your friends or family. Be careful though, if they bailed from their investments it might be a touchy subject. It also might be a nice way to show them why having a goal-focused plan to keep them on track makes sense though.

And, if you know someone who needs a plan, we’re here to help. Our role as a sounding board in our client’s financial lives is something we’re happy to share with others. Thanks for your continued support of our team.

Disclaimer: Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of O’Keefe Stevens Advisory and its contributors and may change without notice. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors.

No responses yet